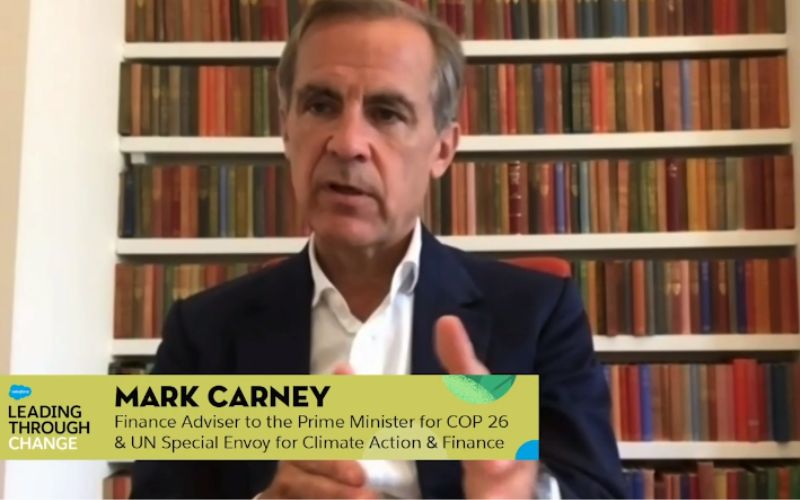

The former Governor of the Bank of England, Mark Carney, has described the COVID-19 pandemic as an “enormous opportunity” for businesses and governments to learn resilience that will help them with the even greater challenge of climate change. Carney, now the United Nations special envoy for climate action and finance, was sharing his thoughts in an interview for software company Salesforce this week.

Mark Carney was Governor of the Bank of England from 2013, leaving in March 2020 just as the UK economy was suffering the first shock of government advice to avoid unnecessary travel and socialising. (The official lockdown came in just over a week later.) In the Salesforce interview, he jokes about the lucky timing of his departure: “I sort of handed over to my successor the smouldering ruins of the economy.”

“Strategic and social reset”

In conversation with Salesforce CEO Gavin Patterson, Carney spoke of the scale of the change caused by COVID-19. “There is a strategic reset for business, but also a social reset that’s going on in parallel. And the strategic reset for business needs to be aligned for where society is going.”

This means that what worked before probably won’t work now: “If you had the right strategy coming in [to the start of the pandemic], you’d be pretty unique to have the right strategy now.”

He believes that the sense of coming together as a community has given people more awareness of existing societal pressures and injustices and more appetite for tackling them. That includes the “intergenerational inequality around climate”.

As we face four major crises – health, economic, equal rights, & leadership, together we must drive change for a better future for all.

— Salesforce (@salesforce) July 6, 2020

Learn how business leaders can help guide the way with Mark Carney, @UN Special Envoy for Climate Action & Finance: https://t.co/jPxa8QCo9v pic.twitter.com/GzgrQ6xmb2

Business response to COVID

Carney suggested that businesses’ response to the start of the pandemic was heavily based in their existing culture. “The best businesses pivoted first and foremost to the safety of their employees, but also tried to work with their suppliers and clients to help them bridge through this period, and engaged with their community.

“Others just hunkered down, pulled down financial lines, and people will notice. I suspect the businesses who had been engaged with others and remained so will be rightly rewarded.”

Leadership in a crisis

Mark Carney was Governor of the Bank of Canada during the 2008 financial crisis, and his actions are said to have helped Canada weather the worst of the storm. Gavin Patterson asked him what he has learned from dealing with various different crises throughout his career. “The first thing is to recognise that those around you need leadership, but also they’re being personally affected. It’s intensely personal, first and foremost. So you need to focus on them and their wellbeing, reaching out.”

The second thing is to strike a balance acknowledging uncertainty and having a plan.

“Plan beats no plan, and a well executed plan beats them all.”

Mark Carney

This crisis is different from many others because of the “radical uncertainty” around health outcomes. “In this situation, it’s not just having a plan but communicating. You have to communicate that you are making assumptions and judgement calls and be clear that if some aspect changes, you will adjust your plan. People will get behind a plan if they understand the reasons behind it, and they won’t hold it against you if the world changes and a 60/40 judgement call lands on the 40.”

“It’s the money not spent which was wasted”

Carney described the pandemic as an enormous opportunity to learn lessons that will help us with other challenges. “What are we learning from COVID? We are learning that you can’t wish away systemic risk. It has relatively low probability at any given time, but it’s a virtual certainty.”

He shared the sobering statistic that the UK’s annual spend on pandemic preparation was less than the GDP lost in a day as a result of COVID. “If we’d spent a day’s worth before, we could have saved a year’s worth of GDP. The cost of preparing in advance is much, much less. It’s the money not spent which was wasted. And climate is COVID on steroids. You can’t self-isolate from it, we’re all going to be brought into it. And to flip it around, it’s an enormous opportunity.”

Businesses need to ask themselves if they’re going to be part of the solution or part of the problem as we transition to net zero and ask themselves what they need to do. “The good news is that there’s huge opportunity associated with that transition. I firmly believe that [reducing to net zero] is what we need not just for climate, but for directed medium-term economic recovery.”

Supporting the private sector to back net zero

Carney is finance advisor to the team running the UK’s presidency of COP26, the conference that was supposed to act as the “first global stocktake” of the 2015 Paris Agreement by assessing how the 125 signatories are doing on their climate promises. COP26, scheduled to take place in Glasgow this year, has been postponed to next year because of the virus, but the drive to cut emissions in those 125 countries hasn’t gone away. Carney is currently working with the Task Force on Climate-related Financial Disclosures to develop standards of information disclosure that will support the private sector to take climate change into account in its decision-making.

“It’s for private capital to think of climate as a source of value. Whether you’re Salesforce, or an airline or a large industrial company, you’re shifting towards a lower-carbon future. Are you ahead of the curve or behind the curve? The question for the providers of capital – and we have over $140 trillion of balance sheet assets asking for this information now – is: what’s your plan as a business to achieve net zero? That kind of focus will bring real change.”

Towards a greener recovery

Carney believes that the chances of a greener recovery are good. Of the European Commission’s proposed €750 billion recovery budget, a third relates to sustainable recovery. Individual countries are showing similar priorities, with Germany putting 40% of its recovery budget into sustainability. He explained that public spending also acts as a signal to the private sector about where the economy is going and where to invest.

Asked specifically about the UK, he said that it’s time for government to set out the direction of the economy and back it up with both spending and regulations. “The regulatory framework is important because the scale of private investment [in the UK] is about £50-60 billion. That’s a huge catalyst. So the advice I would give is: set out the direction of the economy, back it up with spending but also regulatory measures, and the private sector will get behind you.”

Building resilience and solidarity

One of Carney’s key points was that businesses and governments alike need to learn to plan for failure. “One of the lessons of the financial crisis was: don’t kid yourself that the bad thing can’t happen. Figure out what you would do if it did happen. If a big bank fails, how can it do that without bringing everything else down? When you plan for failure, you build in resilience for other things you didn’t think were going to happen.”

Carney believes that COVID-19 has taught us all solidarity and that this new sense of connection will last: “You can’t un-meet your neighbour.” He praised the positive response to the pandemic in most countries, the sense of families, communities and businesses working together.

“It’s entirely natural, having done all that, to then look at climate from that perspective and say: clearly now is the time to address it.”